Oasdi taxable wages calculator

The OASDI tax rate for. There is a maximum yearly amount of earnings subject to OASDI taxes142800 in 2021.

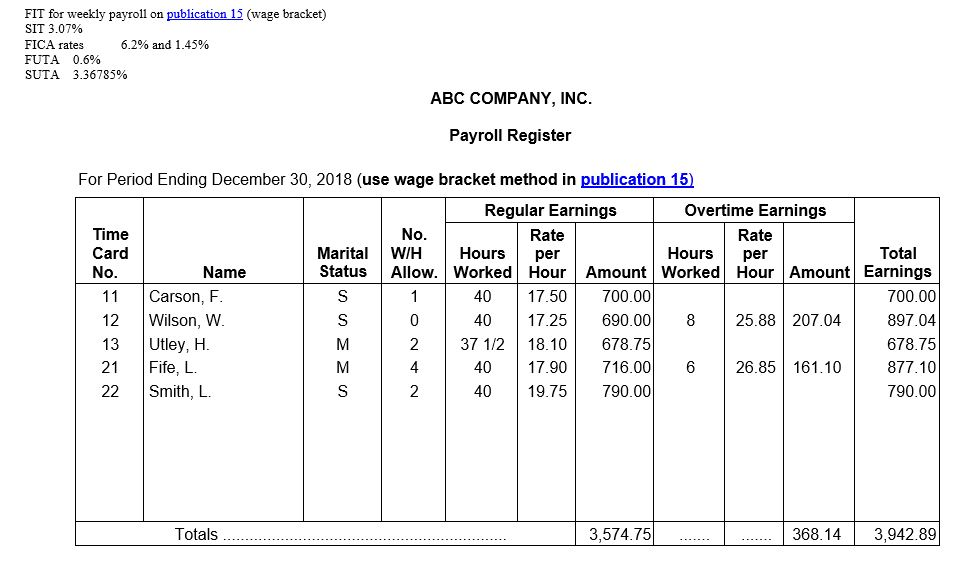

Solved Your Assignment Is To Calculate Oasdi Hi Tax Fit Chegg Com

Lets say you earn.

. According to the Social Security Administration as of 2020 you would calculate OASDI tax at 62 percent of taxable wages up to 137700 for the year. Although we have tried to make this site accurate it is by no. C For 2010 most employers were exempt from paying the employer.

If you worked 40 hours in. There is no upper limit on taxable earnings for Medicare Hospital Insurance. For earnings in 2022 this base is 147000.

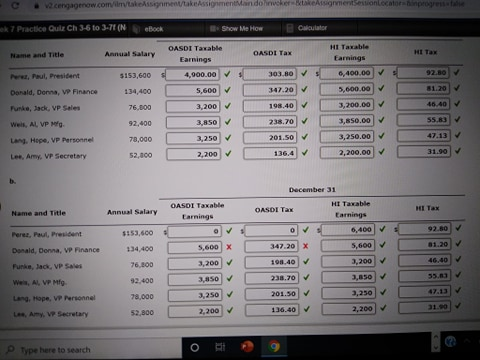

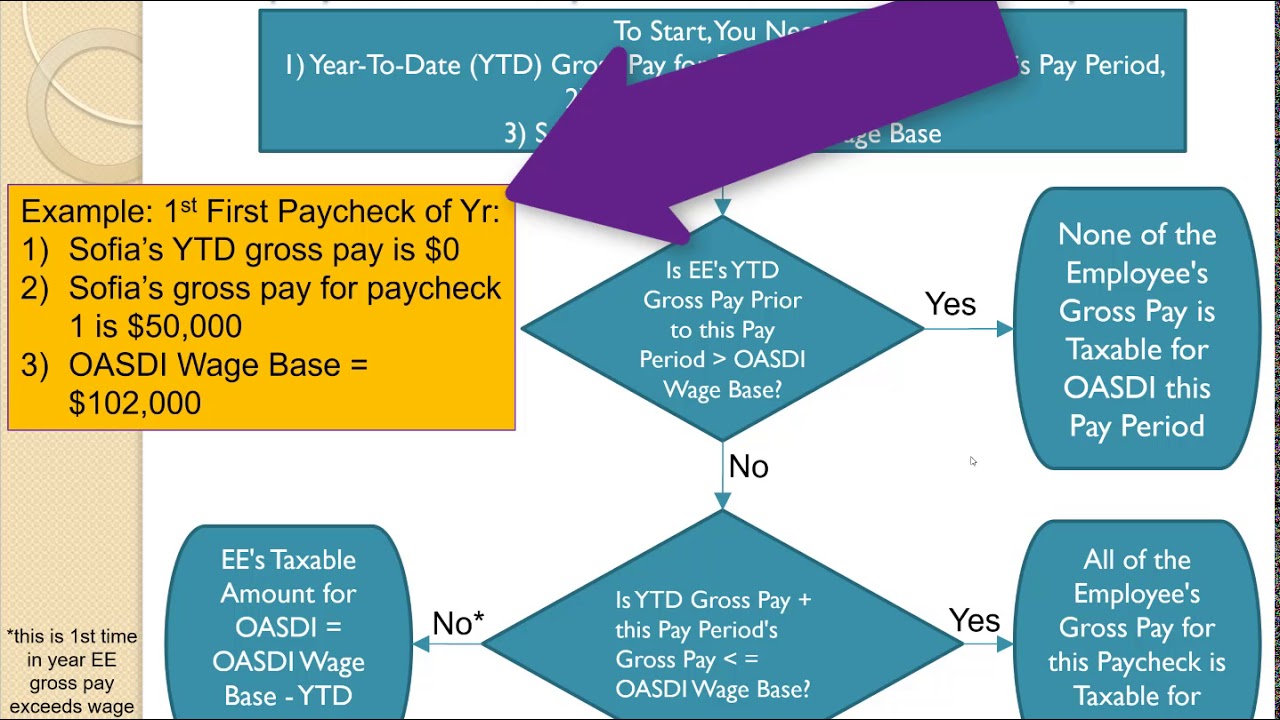

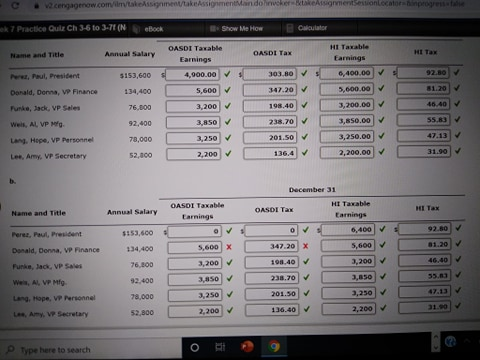

The Old-Age Survivors and Disability Insurance program OASDI taxmore commonly called the Social Security tax is calculated by taking a set percentage of your. Social Security Rate and Limit. 3 Only a portion of Employee As fourth quarter wages are used to determine the SDI taxable wages.

OASDI and Medicare taxes are calculated as follows. OASDI Taxable Wages. The Old-Age Survivors and Disability Insurance OASDI tax is an income-replacement program created to give workers a monthly reliable paycheck upon retirement.

That means that the most that youll pay in OASDI tax is 853740 or twice that if youre self. By law the OASDI tax must be automatically withheld from employee paychecks at a rate of 62 and employers are required to pay a matching 62 for a total tax of 124. The maximum 2020 OASDI portion of the Federal Insurance Contributions Act tax payable by each employee is 853740 or 62 of the wage base up from 823980.

The HI Medicare is rate is set at 145 and has no earnings. Before you learn how much is deducted for OASDI you have to determine the amount of your pay. As mentioned before the Social Security tax is 124 percent of your total earned income which you may pay entirely if youre self-employed and half of it if youre working for.

The actual amount of tax taken from an employees paycheck is also dependent on their filing status single or married and number of allowances both of which are reported. Multiply your gross wages by the withholding rate. We call this annual limit the contribution and benefit base.

Employee A has reached the SDI taxable wage limit of 128298 for the year. Find OASDI - Taxable Wages on the payslip and multiply by 62 percent. This is a type of US tax which will be levied on your income that earned which will be used to fund the.

Calculate Your Gross Income. This amount is also commonly referred to as the taxable maximum. The OASDI Taxable Wages have a wage limit of.

If you earned 475 in gross wages and youre an employee 2945 will be withheld from your. For 2017 the OASDI FICA tax rate is set at 62 of earnings with a cap at 127200 in 2018 this will be increasing to 128400. For 2020 the maximum amount on which OASDI tax gets applied is 137700.

The OASDI tax stands for the Old-Age Survivors and Disability Insurance. The Tax Calculator uses Income tax information from the tax year 2022 to calculate the deductions made on a salary. 35 rows The OASDI contribution rate is then applied to net earnings after this deduction but subject to the OASDI base.

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Payroll Tax Calculator For Employers Gusto

Calculation Of Federal Employment Taxes Payroll Services

Peoplesoft Enterprise Global Payroll For United States 9 1 Peoplebook

How To Gross Up A Net Value Check

Payroll Tax Accounting Ppt Download

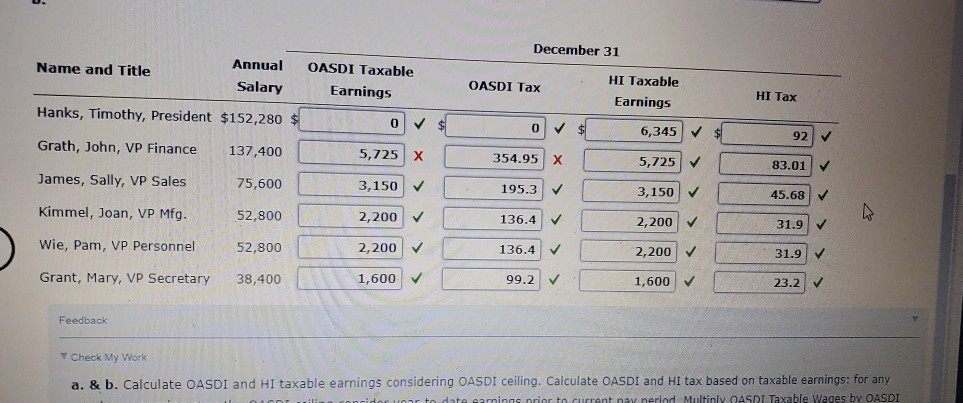

Chapter3payroll Chapter 3 Hw Problems Calculate Oasdi Taxable Wages For Any Employee Earning Over The Oasdi Ceiling Consider Year To Date Earnings Course Hero

Payroll Tax Accounting Ppt Download

Calculating Oasdi Social Security Deduction Medicare Deduction Net Pay Youtube

How To Determine Calculate Oasdi Taxable Wages

Calculation Of Federal Employment Taxes Payroll Services

Payroll Tax Accounting Ppt Download

20190530 180101 Jpg Ebook Calculator Print Item Empty Fields Company Pays Its Salaried Employees Monthly On The Last Day Of Each Month The Annual Course Hero

Social Security Tax Calculation Payroll Tax Withholdings Youtube

2

Solved E Cercanow Com K M Essionmentmandolinwerk Er Seneca Chegg Com

Solved In 20 The Annual Salaries Paid Each Of The Chegg Com