11+ loan decision engine

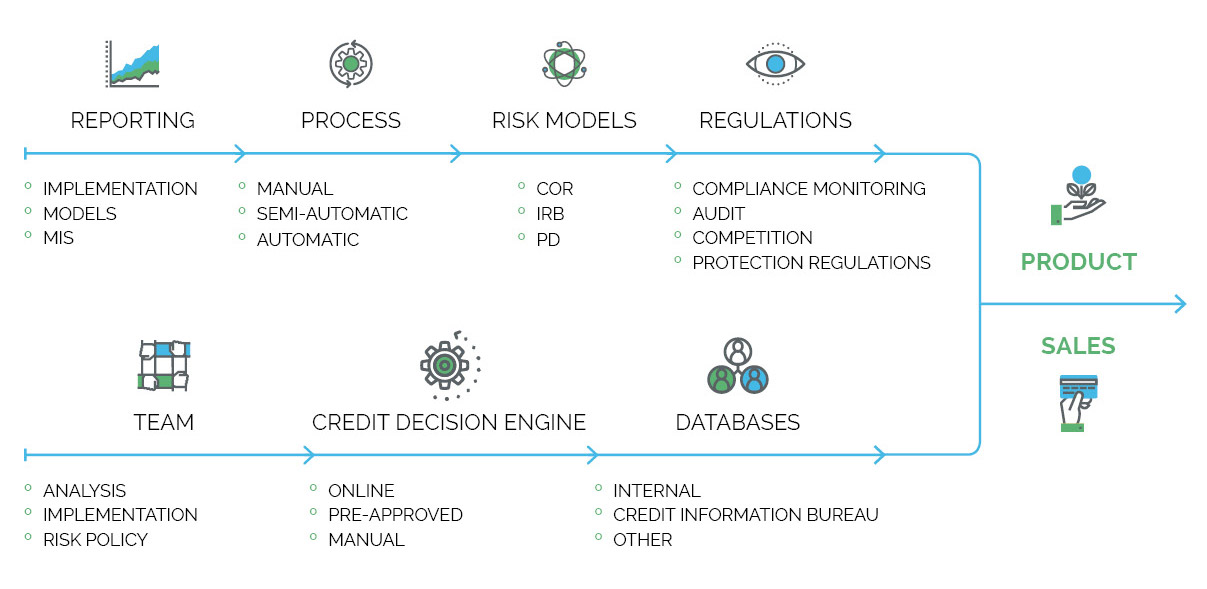

Ad Compare Reviews Get Best Loan with Lowest APR. A Decision Engine enables business users to implement and manage all aspects of the lenders credit strategy.

Financing Education In The Caribbean Countries

In this blog Im going to look at the reasons why having a dedicated decision engine is crucial to lending organisations that wish to grow and rapidly adapt.

. We also leveraged the models to determine the loan to value and collateral requirement. Instead of spending hours of time sorting through data. Provenirs AI Decision Engine simplifies risk decisioning to get new products to market faster using AIML for instant decisions.

The decision engine allows customers to configure and deploy state-of-the. Fraud and identity Make. Though your Decision Engine and Loan Management Software LMS can offer great benefits individually the best benefit to your business and your customers comes when they are well.

However you can use an online personal loan search. View White Paper 2374 KB As financial institutions evaluate ways to find new customers or retain existing fierce competition. The thing is a personal loan is well a personal decision.

Fill in One Simple Form Get The Best Personal Loan Offers for You. White Paper Decision Engines. Theres no one-size-fits-all option.

Credit assets income and collateral. Ad Compare Reviews Get Best Loan with Lowest APR. Each lender and loan varies.

If Approved access funds to help You Build Your Business. Ad Get Low-Interest Personal Loans Up to 50000. Highly accurate loan predictions Integrated.

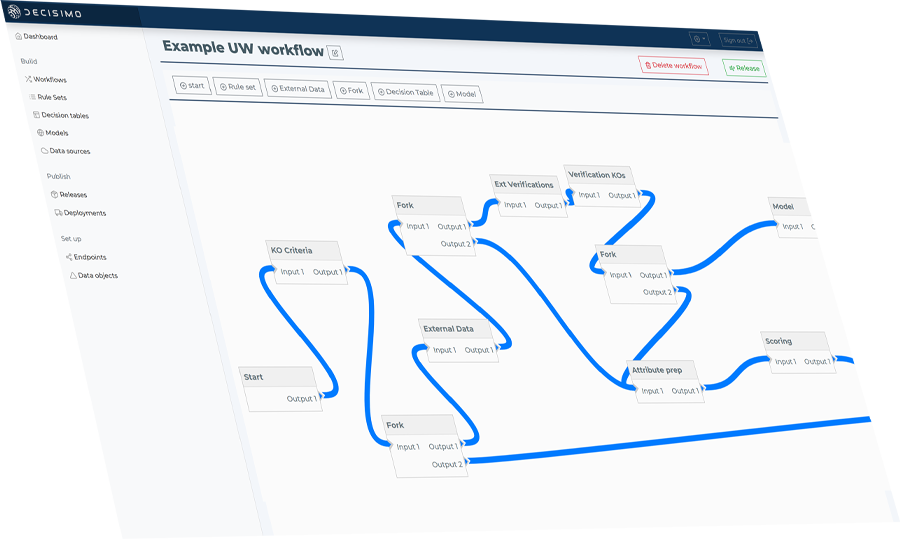

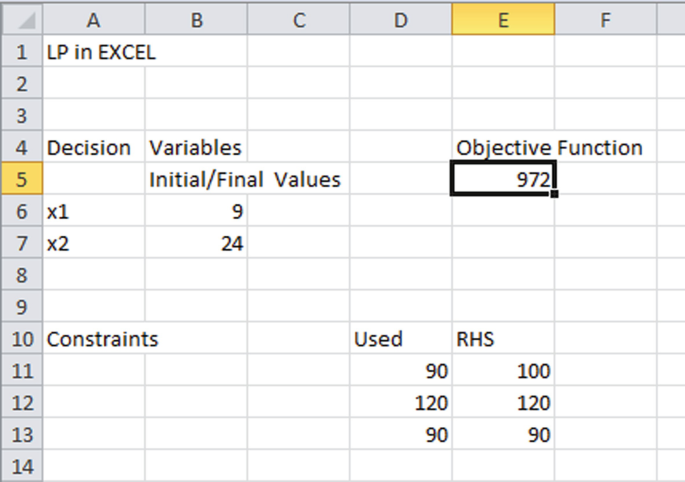

DecisionGenius delivers automated risk-based decisions across the four pillars of underwriting. Our enterprise-wide decisioning engine facilitates faster more streamlined decisions so you can quickly respond to requests and exceed customers expectations. A Loan Origination System will be able to perform some basic scoring and policy rules setting but only a decision engine has the true flexibility and functionality to perform complex calculations.

The scorecard was able to differentiate effectively between low risk and high risk candidates. Quantum AI Loan decision engine powered by Salesforce Einstein artificial intelligence for rapid and accurate loan application decisions. Traditional loan origination software limits your ability to.

Ad Must Have 3k Avg Mthly Rev 18 Yrs Old To Apply Biz 1 Yrs Old. Acticos lightweight decision engine automates the execution of business rules and machine learning models. It also comes equipped with a large variety of tools which enable.

Fast Easy Form. Here are must-haves for decision engine software. Speed The biggest benefit of investing in a decision engine is the ability to monitor applicants credit risk in real-time.

Cefpro S 11th Annual Risk Emea Summit

Success Story Financial Decision Engine Aterise

Credit Decision Engine In Practice With A Mortgage Example

Iq Decision Engine Power On The Most Advanced Credit Decisioning

Decision Engine Solution By Appello

Credit Decisioning Actico

Iq Decision Engine Power On The Most Advanced Credit Decisioning

Credit Decisioning Software Soft4leasing

Credit Decisioning Engine Lendflow

Effective Credit Risk Management Ama

Fintech Credit Decision Engine Decision Intelligence Services

Non Banking Financial Company Gold Loan Provider In India Kerala Manappuram Finance Ltd

Adept Decisions Decision Engine Loan Origination Systems

Mathematical Programming Linear Integer And Nonlinear Optimization In Military Decision Making Springerlink

Financial Technology Archives Signzy

Blog Fintech Forum Europe Since 2013 Award Winning Insights On What S Next In European Fintech From The Startups Investors And Financial Institutions Making It Happen

Credit Decisioning Actico